Navigating the Landscape of State Property Taxes: A Comprehensive Guide

Related Articles: Navigating the Landscape of State Property Taxes: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Landscape of State Property Taxes: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of State Property Taxes: A Comprehensive Guide

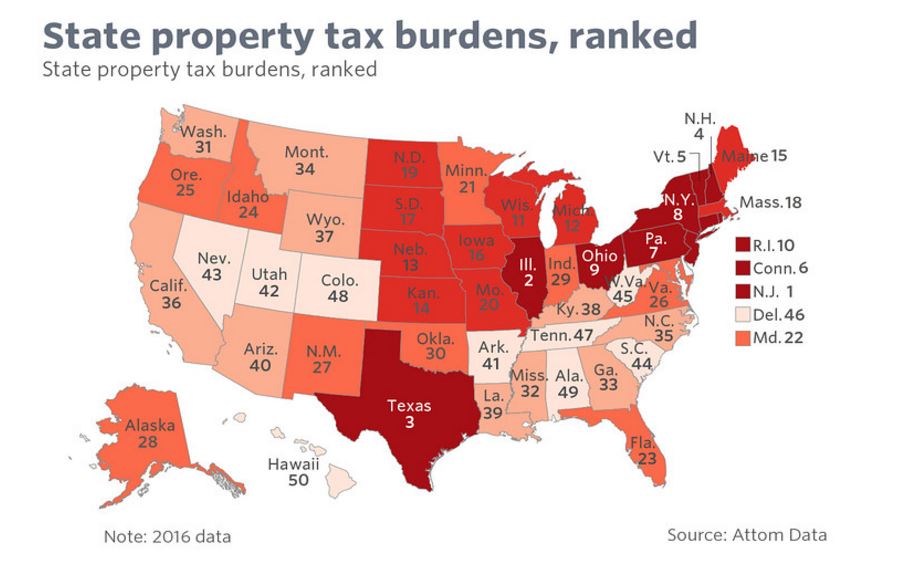

Property taxes, a cornerstone of local government funding, vary significantly across the United States. Understanding the intricacies of these taxes, particularly on a state-by-state basis, is crucial for both homeowners and businesses. This article aims to provide a comprehensive overview of state property tax maps, their importance, and how they can be utilized effectively.

Understanding the Basics

Property taxes are levied on real estate, including land, buildings, and fixtures, and are typically calculated as a percentage of the assessed value of the property. The assessed value, which is determined by local government assessors, is often a fraction of the market value. State property tax maps are visual representations of these tax rates across different regions within a state. They provide a clear picture of how property taxes vary geographically, highlighting areas with higher or lower tax burdens.

The Importance of State Property Tax Maps

State property tax maps serve a multitude of purposes, offering valuable insights for various stakeholders:

-

Homebuyers and Sellers: These maps enable potential buyers to compare property tax rates across different neighborhoods or cities within a state, informing their decision-making process. Sellers, in turn, can use this information to understand the potential impact of property taxes on the desirability of their property.

-

Real Estate Investors: For investors seeking to acquire properties for rental or development, understanding the local tax landscape is crucial. State property tax maps allow them to identify areas with favorable tax rates, potentially maximizing their returns.

-

Local Governments: These maps provide a visual representation of the tax burden on property owners within their jurisdiction. This information can be used to assess the effectiveness of current tax policies and to inform future policy decisions, ensuring a balanced approach to revenue generation and property value preservation.

-

Researchers and Policymakers: State property tax maps serve as valuable data sources for researchers and policymakers seeking to understand the impact of property tax policies on economic development, housing affordability, and other social and economic factors.

Interpreting State Property Tax Maps

State property tax maps typically use color gradients or other visual cues to represent varying tax rates. Understanding the legend and key used on each map is crucial for accurate interpretation. Some maps may display tax rates as a percentage of assessed value, while others may represent the actual dollar amount of taxes per $100,000 of assessed value. It is important to note that maps may not always reflect all relevant factors, such as exemptions or abatements, that can influence the actual tax burden.

Navigating the Data Landscape

Numerous resources are available online to access state property tax maps:

-

State Government Websites: Most state government websites offer interactive maps or downloadable data files containing property tax information. These resources are often maintained by the state’s department of revenue or taxation.

-

Real Estate Websites: Popular real estate websites, such as Zillow, Realtor.com, and Redfin, often incorporate property tax information into their listings, allowing users to compare tax rates across properties.

-

Local Government Websites: Individual cities and counties may also provide property tax maps or data on their websites, offering more localized information.

-

Third-Party Data Providers: Specialized data providers, such as CoreLogic and ATTOM Data Solutions, offer comprehensive property tax data sets that can be accessed through subscriptions.

FAQs Regarding State Property Tax Maps

Q: What factors influence property tax rates within a state?

A: Property tax rates are influenced by a multitude of factors, including:

-

Local Government Budgets: Higher local government expenditures, such as those for schools, infrastructure, and public services, often translate into higher tax rates.

-

Assessed Values: The assessed value of properties, which is determined by local assessors, plays a significant role in calculating property taxes. Higher assessed values generally lead to higher tax bills.

-

Exemptions and Abatements: States may offer exemptions or abatements for certain types of properties, such as those owned by seniors, veterans, or charitable organizations.

-

Tax Rate Limits: Some states have limits on the maximum tax rate that can be levied on property.

Q: How can I find the property tax rate for a specific property?

A: To find the property tax rate for a specific property, you can:

-

Use online property tax calculators: Many websites offer calculators that allow you to input the property’s address and assessed value to estimate the tax liability.

-

Contact the local assessor’s office: The assessor’s office for the jurisdiction where the property is located can provide the exact tax rate and any applicable exemptions.

-

Review property tax records: Publicly available property tax records often include the tax rate and other relevant information.

Q: Are property tax rates always consistent within a state?

A: Property tax rates can vary significantly within a state due to differences in local government budgets, assessed values, and other factors. For example, areas with higher property values may have higher tax rates to fund local services.

Tips for Utilizing State Property Tax Maps

-

Compare multiple sources: Consult different sources, such as state government websites, real estate websites, and local government websites, to ensure accurate and comprehensive information.

-

Consider the map’s limitations: Be aware that maps may not always reflect all relevant factors, such as exemptions or abatements, that can influence the actual tax burden.

-

Consult a tax professional: If you have specific questions or concerns about property taxes, it is always advisable to consult with a qualified tax professional.

Conclusion

State property tax maps provide a valuable tool for understanding the complex landscape of property taxes across different regions. By leveraging these maps, homeowners, investors, local governments, and policymakers can gain valuable insights into the distribution of property tax burdens, informing decision-making processes and ensuring a fair and transparent tax system. As property tax policies continue to evolve, these maps will remain an essential resource for navigating the ever-changing landscape of real estate taxation.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of State Property Taxes: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!